With easy access to finance thru individuals fund helps you see immediate means and you can fulfil your goals. All the money come with the eligibility conditions, a personal loan to fund health care otherwise a married relationship, a mortgage becoming a homeowner otherwise a corporate mortgage to increase the company’s growth.

In order to one another be eligible for that loan and now have it into aggressive terminology, your credit rating is actually several you cannot disregard. A credit history above 750 reflects a great economic health and grows your chances of delivering a reasonable approve for the flexible conditions.

How does your credit score matter while you are trying to simply take financing

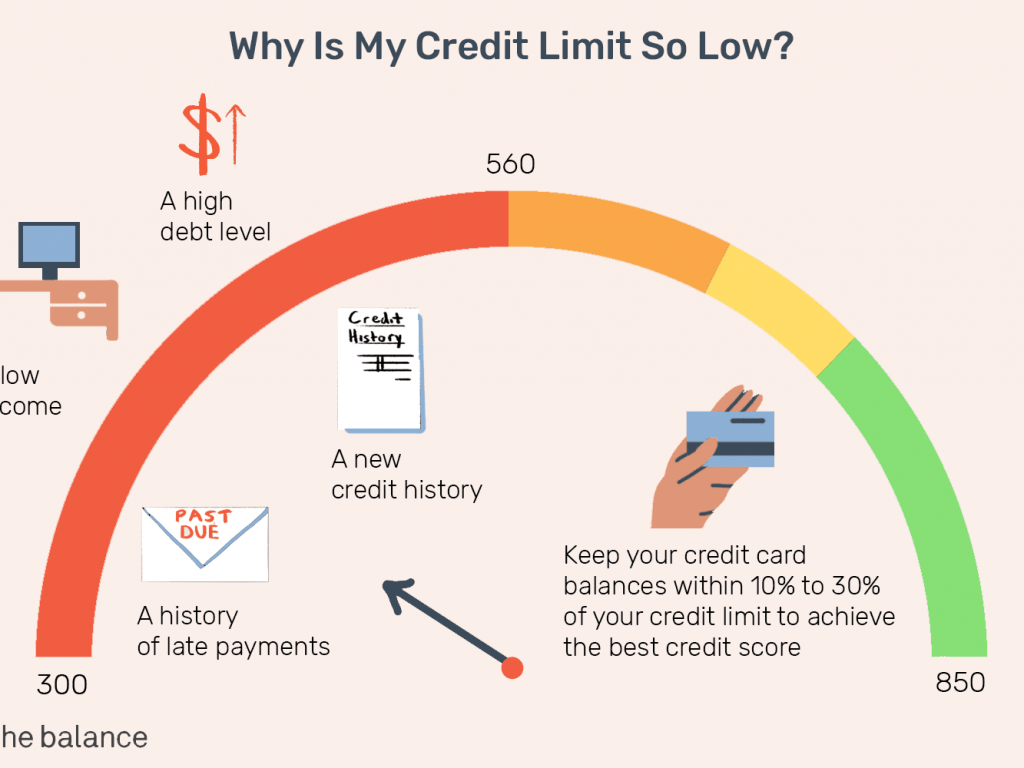

Your credit score displays their creditworthiness and allows your own bank to help you legal your application just like the a prospective borrower. Its a bottom line of your credit score and how sensibly you have looked after borrowing before. Your credit score reflects the trustworthiness because considers things like prompt fees out of EMIs, your own borrowing from the bank utilisation, your own credit concerns, plus established obligations. A good credit score shows the lender that you’re financially secure and you can in control having borrowing.

not, remember that credit history is not the merely conditions in the process of qualifying for a loan and delivering recognition on your application. Other variables like your paycheck, town of residence, present loans, employer, etcetera., in addition to are likely involved.

Whenever you are a good credit score is important irrespective of the type away from investment you are searching in order to avail, here are the top score which can help you rating an effective ideal offer on the loan.

Top credit rating so you’re able to get a personal loan

Your credit score is a huge foundation choosing your qualifications for a personal bank loan since it is a guarantee-free financing. Minimal CIBIL get to own a personal loan is between 720 and you will 750. Which have so it rating means youre creditworthy, and you may lenders commonly agree your application for the loan rapidly. They ount within a moderate desire.

Even though you might still be able to get a personal bank loan which have a credit score anywhere between 600 and 700, the lower your own score, the reduced the recognized amount borrowed could be. A credit score less than 600 is recognized as inadequate for personal money usually.

Better credit score so you’re able to get a corporate mortgage

While you are trying to get an equity-free organization mortgage, which have a credit score out-of 700 or higher is most beneficial. While obtaining a protected team mortgage, your loan app could be recognized which have a lesser credit rating, state ranging from 600 and 700 also. These two problems try genuine while you are obtaining an excellent providers financing as the just one, whether it’s a personal-employed top-notch such a california otherwise engineer otherwise doctor otherwise self-employed low-professional like a trader or brand name.

not, while you are trying to get a business loan just like the an entity, be it a partnership, Limited-liability Union, Personal Minimal, otherwise a closely stored limited business, your company credit score matters except that your personal credit rating. In such cases your own CIBIL rank or Equifax providers credit score was checked by the financial.

Most readily useful credit rating to possess lenders

Home financing are a secured financing as the domestic your try buying will act as the newest collateral. Hence, you can rating a home loan regardless of if your credit score is leaner than simply 750. Specific lenders sanction lenders in case the credit history is around 550 or more.

It is important to just remember that , the reduced your credit score try, lower the amount borrowed is sanctioned on recognition. That’s why obtaining a big amount borrowed if for example the credit rating was reasonable isnt recommended. Oftentimes, loan providers promote simply 65% or a reduced amount of the mandatory loan amount when your credit history was lowest. It might be far better replace your credit rating before applying to possess a home loan.