Basically in initial deposit is actually compiled to cover the costs out-of a keen appraisal and you will credit history that can otherwise may possibly not be refundable

Credit Data source – A business that gathers, preserves, places and sells financial and in public places recorded information about the latest fee information men and women obtaining borrowing from the bank.

Can be utilized in conjunction with loans Lynn AL real sales to determine if bucks or credit was fueling gains. Frequency: month-to-month. Source: Government Set aside.

Damage – Extent recoverable of the somebody who has been damage inside the one styles from operate or standard of some other.

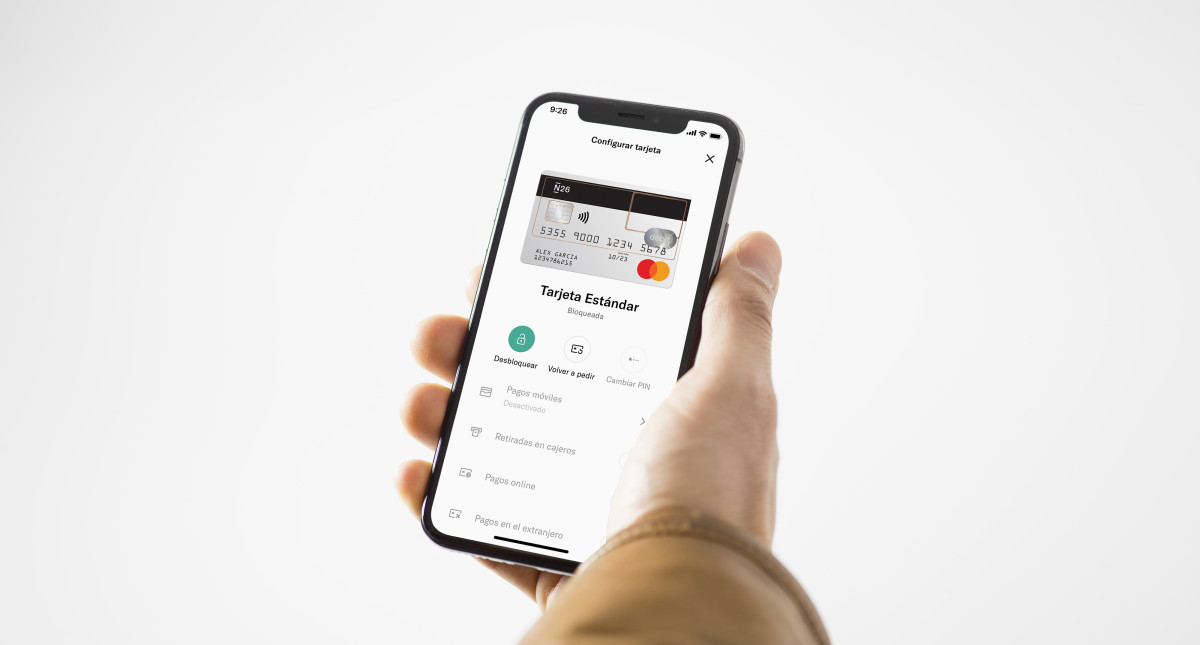

Debit Credit (EFT) – A credit card which looks like a credit card, you to users are able to use and come up with sales, distributions, and other style of electronic fund transfers.

Deed – Brand new authored appliance one to conveys a house throughout the merchant to help you the customer. The deed was registered within local courthouse therefore the import off control belongs to the general public record.

Deed out of Trust – So it document, known as home financing in a number of states, guarantees a property so you can a loan provider otherwise trustee because the safeguards to have the fresh repayment off a loans.

Deed Stamp – A taxation that’s needed is in certain municipalities if the property changes hand. The degree of this income tax can differ with every condition, town and you can county. In regards to our comparison purposes, which fee represents a taxation or any other inescapable commission.

Deed-in-lieu – A process that allows a debtor to transfer the ownership out of a property into the financial in order to avoid loss of the house or property compliment of property foreclosure.

Put – Funds necessary for a lender in advance of new control away from financing consult

Standard – A beneficial breech of arrangement which have a lender like the incapacity while making loan payments on time.

Beginning Percentage – A fee billed generally by identity company or attorney getting the latest birth regarding data files on bank. For the evaluation aim, brand new beginning payment is considered to be a third party payment.

Agency regarding Experts Affairs (VA) – An agency of the federal government that give services and you can guarantees home-based mortgage loans built to qualified veterans of your own army properties

Disregard Factors – Charges that are gathered by financial in return for an effective lower interest. Per dismiss area was 1% of amount borrowed. For the comparison motives, a benefit section is considered to be a loan provider fee. To choose when it is wise to shell out discount factors to receive a reduced speed, you need to evaluate the fresh up front cost of the brand new points to the month-to-month offers one come from getting the down rate. Sometimes called « points ».

Dismiss Speed – The speed that Federal Set aside charge member finance companies for fund, playing with regulators securities or qualified report since the collateral. This provides you with a floor to your interest levels, given that finance companies put the financing prices a level over the discount rate.

File Preparing – Lenders will prepare yourself a few of the court data that you’ll end up being finalizing during the time of closing, for instance the home loan, note, and you may specifics-in-credit report. This payment covers the costs from the preparing of them data. For our comparison intentions, this new document planning charges are thought as a loan provider fee.

Documentary Stamp – A tax levied of the particular local otherwise county governments in the day the fresh deeds and you may mortgage loans is actually registered toward social number. In regards to our review aim, documentary press are considered to-be a tax or other inevitable fee.

Down-payment – New portion of the purchase price out of property that the debtor might be expenses within the cash unlike included in the home loan matter.