Only if one to mate try listed on the mortgage and the borrowing mate desires to move out, brand new low-borrowing from the bank companion will have to re-finance the mortgage.

Anyway, should you get a splitting up, you’ll have to complete their split up decree towards lender to maneuver pass along with your choice.

Who’s believed a non-credit spouse?

- Partnered towards the debtor during the time of the latest loan’s origination

- Dependent once the an eligible, non-borrowing lover with a lender during the conception of one’s mortgage

- See every requirements with the reverse mortgage, and additionally keeping the house or property and spending fees and insurance policies

Whenever you are detailed because an eligible, non-borrowing lover and you also and your mate score a divorce case, the option to stay in your house relies on their opposite home loan conditions plus the divorce case contract.

Usually, the most suitable choice getting a spouse who would like to stay static in our home but is perhaps not noted as the a co-borrower should be to refinance the loan.

What goes on if you get remarried?

When you yourself have a contrary mortgage and you will as time goes by marry once more, your brand-new partner won’t have HECM defenses for many who flow out otherwise die.

In this scenario, it’s best to re-finance to the yet another mortgage so the the latest lover might be placed into the loan, sometimes given that a great co-borrower (in the event the eligible) or due to the fact an eligible, non-borrowing from the bank mate.

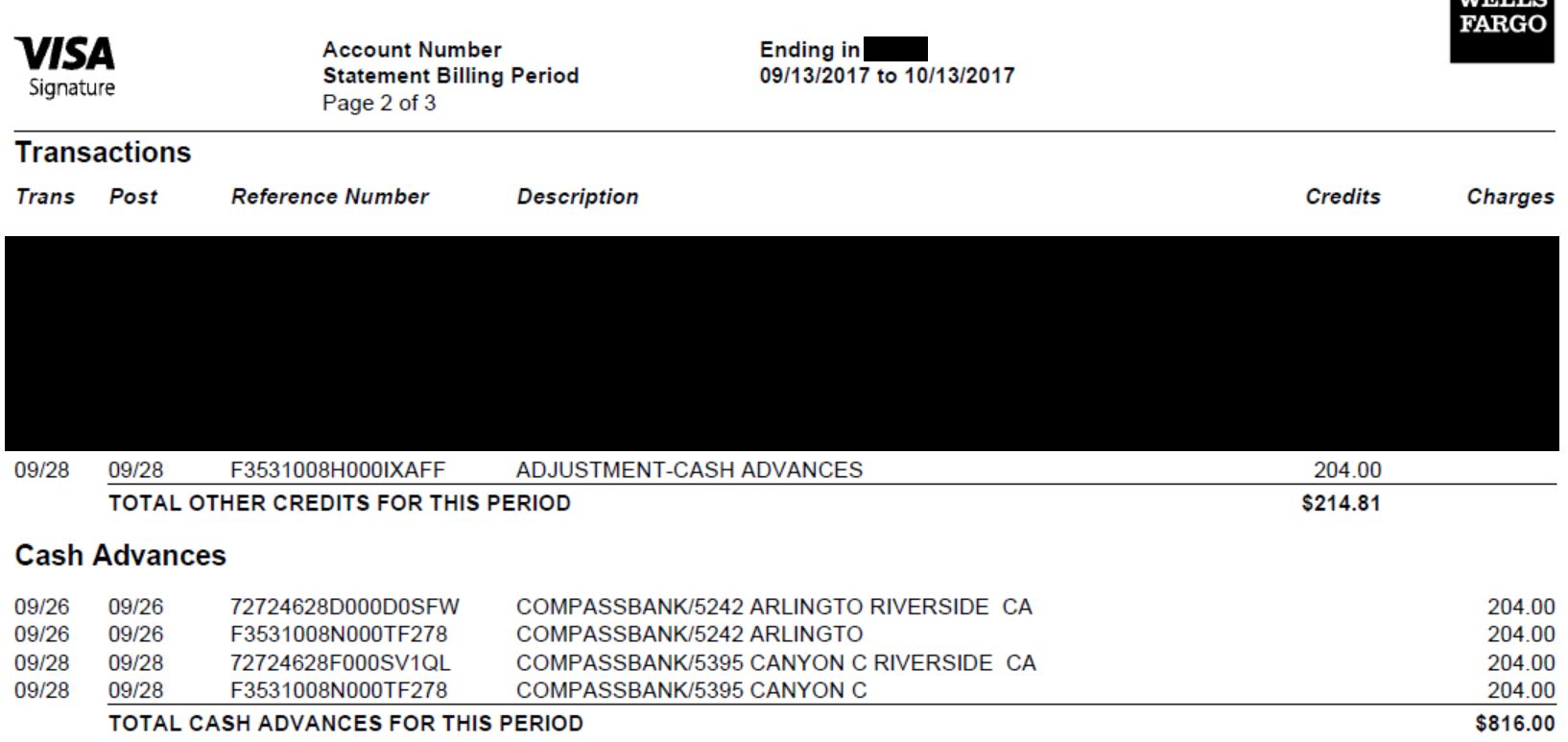

The fresh friendly, educated financing masters on Compass Mortgage will be ready to make it easier to and extra mention the contrary home loan possibilities.

Brand new Compass Mortgage group food our individuals for example family members. The core values-excellence, stability and also the infinite worth of men we fulfill-are whom we’re as well as how i do business..

We possibly may desire speak with that talk about your reverse financial selection that assist your open the big masters which loan proposes to people who be considered.

Sign up for a reverse home loan now to supply all of us with first details about oneself plus property, otherwise call us at the (877) 635-9795 to talk to a loan administrator now.

Breakup should be tricky – one another economically and you may emotionally. Contributing to this new complicated processes try behavior you have to make throughout the your property and you can mortgage. The latest relationship home is the house to your largest monetary worth, so choosing simple tips to equitably separate a property results in sharp disagreement. However, home loan repayments do not prevent into the divorce case, and in the end, it needs to be decided that are guilty of the brand new mortgage repayments. If you’re considering a separation and divorce, and also questions relating to the courtroom and financial rights since it identifies your property and you may mortgage payments, believe checking out having an experienced Tx loved ones legislation attorney within Texas Breakup Laws Class at (720) 593-6442 now.

Breakup and your Financial Selection

In the event your name of your house boasts title out of one another partners, upcoming both spouses will stay in control to invest the newest mortgage, regardless if one mate moves short term installment loans online direct lenders aside based on Colorado legislation. On the other hand, fees and other debt for the house are however the latest monetary obligations out-of both spouses until the finalization of one’s splitting up.

However, there are a selection away from choices for exactly how a couple could possibly get handle a marital domestic in a separation and divorce, that trust products like fico scores, house collateral, and you will regardless if one-party wants to stay in new domestic. The following are the most used possibilities one to divorcing spouses consider regarding the relationship domestic.

Refinance the home

Immediately following possessions and you will expenses are completely computed and calculated, a great divorcing couple produces the decision to re-finance a together stored financial for the one term. Which leads to one lover preserving ownership of the property just like the better as the obligations to expend the loan of the home. Others partner would be free of one home loan obligations and you can its label taken from brand new title.