Purchasing your first house or condominium is definitely a monumental action, but gradually increasing home values make affording a home even more challenging for many first-day homeowners. Highest can cost you, changing mortgage prices, and a decreased homes for sale have remaining aspiring home owners impression overwhelmed.

If you find yourself one of them, need cardiovascular system during the comprehending that let is obtainable. First-day homebuyer or other loan applications makes it possible to reach finally your imagine homeownership sooner than you think.

Tips

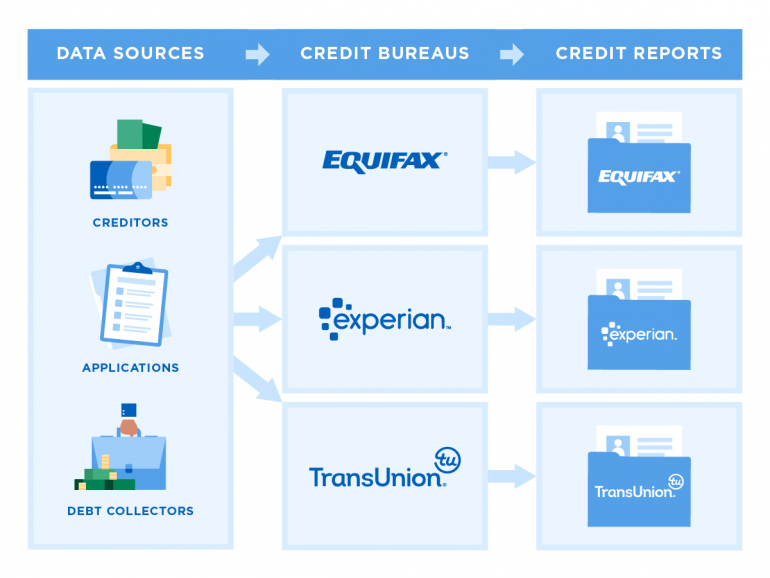

- Authorities mortgage applications eradicate chance from the guaranteeing mortgage loans, promising loan providers to include finance so you can consumers which have faster down payments.

- Federal national mortgage association and Freddie Mac computer give low-down commission programs to first-time homeowners whom meet their requirements.

- Condition governing bodies and you can nonprofits enjoys earliest-day homebuyer applications for eligible people.

Bodies first-date homebuyer apps

Bodies mortgage apps causes it to be more straightforward to buy a home, even though you’ve never done they before. Per system possesses its own standards, but a beneficial mortgage broker makes it possible to contrast possibilities.

FHA loan. New Federal Homes Government offers that loan that enables you to definitely put only 3.5% off if you have a credit rating of at least 580. Even after a reduced credit history, a keen FHA financing is also open the door in order to homeownership when you’re in a position to put down 10%. Our home rate have to satisfy conforming limitations for the county in order to qualify. You must together with live on the house or property (that will have doing four units) as the a primary quarters for around per year.

- Energy-efficient Home loan System. This will help to the price of to acquire a property and you will expenses to possess opportunity-effective upgrades of the plus them on your mortgage.

- 203(k) Rehabilitation Home loan Insurance rates Program. For property which can be at the very least a year old and want updates and you can solutions, this method brings financing to assist on the buy and treatment regarding property, townhouse, otherwise condo.

- Good neighbor Next door. Pick a specific noted assets for a cheap price and you may alive here for at least three years. In order to be considered, you must be a great firefighter, the police administrator, emergency scientific professional (EMT), or professor.

USDA loan. The Albertville loans new You.S. Service out of Farming also provides financing program intended for becoming more buyers buying residential property when you look at the outlying section. You can qualify for a no-down mortgage for people who fulfill specific income standards. You must are now living in certain specific areas, however, if you will be willing to create one to disperse, you will get let to invest in a property without worrying on the good advance payment.

Va loan. Eligible services players and you will pros (and regularly their partners) is be eligible for a no-off mortgage about Service of Pros Activities. A certificate of qualifications and a financing commission, which can be folded into financing, are essential. Coping with a loan provider experienced with Virtual assistant finance may help expedite the program procedure.

Indigenous American loan. Members of federally acknowledged people have access to Section 184 capital so you’re able to help get a house in recognized areas. Candidates have to manage lover loan providers and buy features with four or fewer tools. Like many authorities financing apps, your house rates need to be within your county’s compliant constraints.

Old-fashioned earliest-time homebuyer loan apps

Federal national mortgage association and Freddie Mac computer, both authorities-paid businesses in conservatorship of Federal Construction Financing Institution (FHFA), supply software that assist consumers be eligible for mortgage loans. Each other enjoys borrowing from the bank criteria which might be much more strict than those regarding bodies mortgage apps, but you can constantly pick which have only step 3% down:

- HomeReady. Fannie Mae’s system comes with a good $dos,five hundred borrowing from the bank to own reduced-money consumers to help with closing costs or a downpayment.