Important: If you have observed actually one or two of them features for the a possible financial, it’s to your advantage to be careful and you may search help off a proven predatory financing attorneys from inside the Fl once it is possible to.

Legal Reasons for a lawsuit

If you were brand new target off illegal credit ideas, you are thinking, do i need to sue my mortgage company to possess predatory lending? For example, there are various federal and state laws that help to guard individuals of unethical and you will hazardous lending methods. Very, exactly what are reasons to sue a mortgage team? Essentially, the preferred judge grounds to sue mortgage lender to possess predatory credit are however, are not restricted to the following:

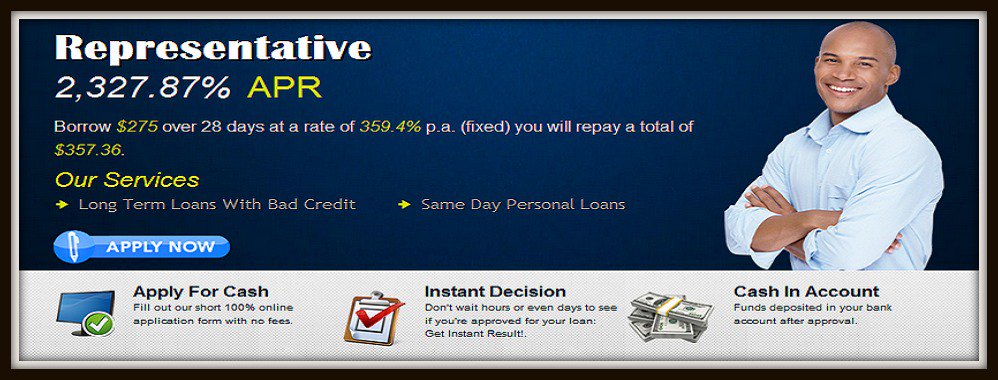

- Insights within the Credit Act (TILA): So it federal legislation helps it be compulsory to possess financial people to reveal an entire and you can correct will set you back off a loan. This consists of interest levels, fees, or any other conditions. If you think their mortgage lender broken TILA disclosures, you’ve got a very good basis to possess case.

- Home ownership and Collateral Defense Work (HOEPA): That it especially aim those people higher-costs mortgage loans if you find yourself delivering necessary protections to have borrowers. It is critical to keep in mind that HOEPA finance must adhere to much stricter laws. Violations of these guidelines can result in extremely serious consequences to possess lenders.

- Condition and you can Local Consumer Shelter Regulations: Florida’s consumer defense rules express similarities along with other states, plus have numerous variations. You will need to get in touch with your own lawyer understand exactly how user safety laws regarding the condition can use for the situation.

- Almost every other Federal Regulations: According to your role, most other federal guidelines might use, like the Home Payment Measures Act (RESPA) and therefore handles you from kickbacks and particular fees. Subsequent,This new Equivalent Credit Options Act (ECOA) helps you to protect you from discriminatory credit means that will be centered on your race, gender, religion, etc.

If you’re considering searching for lawsuit facing your own lending company, it is important to circulate immediately as the you’ll need to document your own situation till the statute of constraints ends.

Exactly how an attorney May help

Oftentimes, it is in your best interest to employ legal counsel to sue mortgage company. As to the reasons? As the mortgage company will work with a high-driven firm. For this reason, otherwise, you will end up at a definite disadvantage. At the same time, your attorneys normally:

- Familiarize best reviews installment loans bad credit la OR yourself with your own Situation: For example examining the loan data, activities of the cases and you can pinpointing specific violations of guidelines and laws and regulations.

- Navigate Complex Laws and regulations: Legal counsel can also be show you through the particulars of cutting-edge predatory lending legislation on federal, county and you may regional levels.

- Create an effective Conflict: Along with proof collection, deals with your financial, case laws precedent and a lot more, so you’re able to create a stronger case.

Contrasting Your role

Just before entering people legal action, its crucial to determine your situation carefully. Is in which a little detective work goes a considerable ways. Because of the closely examining your loan records and you can collecting facts, you could potentially know if you have been a goal out of predatory credit practices. Our very own user attorney at the Ziegler Diamond Legislation was here to guide you step-by-action from the research techniques. Like that it is possible to make the best decision about your highway forward. When you run you, the comprehensive evaluation will include:

Assessing Your Home loan

Among the first procedures we shall need is to very carefully remark the financial files. This may tend to be placing a magnifying glass on the interest rate, charge as well as your cost agenda. Next, we shall compare their words towards current market standards. This will help all of us know should your words was in fact normal and you may court during the time you closed your financial.