- #1

Participant

- #dos

Well-recognized member

- #step three

Site Class

Are you searching to buy the brand new? Financial support was burdensome for RVs more 5-six yrs old and 10 years is beyond the fresh limitation off just about every Camper resource group. A hefty down payment seems to be requisite too.

If or not an Rv financing try assumable or not utilizes the brand new bank, and that means you will have to address one question after you look for one you love that current financial support. To assume that loan, you have to get out of the earlier in the day user’s security (or no), to make sure that can get mean a downpayment too.

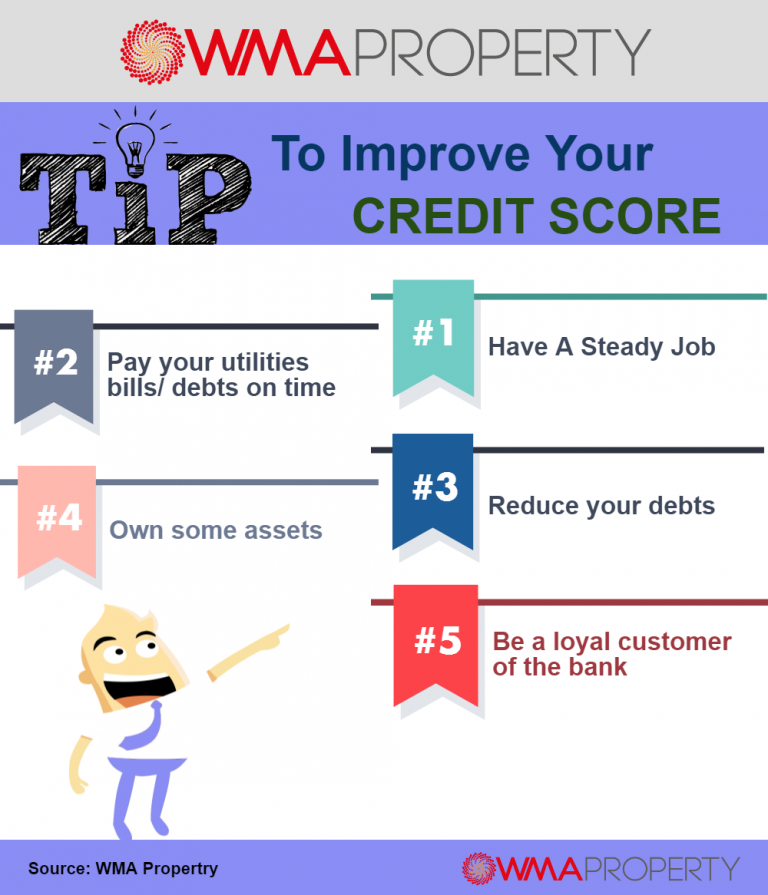

Diminished a credit record is a problem, so you should start building certain borrowing from the bank in the event you need it in the future. g. fuel into car) and you will pay it back when owed. Make a reputation.

The suggestion out of a home collateral line of credit are a great a great one to as well – take advice from the financial institution(s) you are doing team approximately one.

- #cuatro

Well-recognized affiliate

We concur that property collateral line could well be a choice or rating a financial just to safer a genuine Rv financing contrary to the collateral at home. You’ve got a two fold whammy. Possessing a business and you will lack of credit rating when you’re spending bucks for whatever shows up. When you yourself have strong team financials and you will taxation statements demonstrating brand new net gain and you will what you are pulling and you may people draw don’t have a problem getting credit. What bank can you play with for your needs? They must have to assist you specifically if you consent in order to automobile subtract for your costs.

- #5

Well-recognized member

Once the Gary said, investment has become much harder for RV’s loans New Port Richey East because 2008 and 2009. I believe the brand new economic crisis brought about a rigorous money problem having loan providers that inspired resource with the house, RV’s or other big ticket points. A number of the lenders you to funded RV’s already been just resource new RV’s simply because they had been are significantly more choosy.

That said, I funded mine thanks to my regional credit partnership at the a highly low interest (a little over step 3%) last year. The latest motorhome I purchased try eleven years old at the time and i also bought it at a cost which had been lower than lower merchandising. The financing partnership funded the acquisition 100% together with fees and you will registration costs and you will didn’t need us to spend a deposit. Offered, We simply financed they more than a beneficial 4 12 months identity, however they might have done they getting seven so you can a decade within a slightly large rate of interest. My credit history is over 800 today but wasn’t on enough time I financed this new Rv.

When you are a person in a card commitment, are you to channel. Otherwise, of a lot borrowing unions is actually available to the fresh players now and you also might just sign up one that is common and experienced with Camper capital.

- #6

Effective affiliate

rv resource should be all around the map. in addition to economic crises of some years ago possess lenders runnin for safety.

It said since I did not individual a property (offered a couple of years back) together with no documented exposure to expenses highest share, long-term rv layout costs, they may offer to invest in an any rv loan. its idea were to wade get one any place else and i also you certainly will transfer the mortgage to them from the a very sensible rates after i got repaid properly to possess a year to the highest price loan.

The fact that We have property (my IRA) that have been worthy of a couple of times the value of the borrowed funds I are seeking to failed to frequently number possibly.

I contacted my personal credit commitment as well as said they may mortgage me personally money at over 8.00 %, however, limit title are such as 4 years. it was not attractive towards the 60k I happened to be trying financing. the individual with the phone told you, the borrowing relationship had elected to not ever enter the brand new camper industry (highest standard/repo price is my personal suppose)

I quickly contacted my personal lender more than 20 years, Wells Fargo. despite an 840 credit rating, the best the bank offered myself is actually sumptin to the purchase off ten.5 % hence, in the modern business, appeared like path robbery.

Searched up a couple of online « i fincance RVs » everyone online and you may is rejected by for every therefore. doesn’t individual a house was the fresh new driver into the such circumstances.

Around the period We receive a beneficial product I was interested on LaMesa Rv, within the Tucson, AZ. They hooked me up with Alliant Credit Connection (1-800-23902829). It got my loan instantaneously from the cuatro.forty two %, to the an effective a six year old mentor, 30k kilometers.

realization. the attention regarding lenders is more heck towards rv financing. dealing with a good used tool thu a massive specialist can get u solutions that your individual lender does not offer you and you can mortgage nearer to practical than you possibly might be able locate oneself.

alliant borrowing from the bank relationship is prolly really worth a visit. he or she is actively in the market regarding lasting investment RVs one another the fresh and you can utilized.