Just how long Do Virtual assistant Loan Pre-Recognition Capture

Are you considering trying to get an excellent Virtual assistant loan? If that’s the case, you might be curious how much time it entails to locate pre-approved. Of a lot potential homebuyers is actually amazed to track down that the Virtual assistant loan procedure is fairly quick and easy compared to the extremely traditional mortgage loans.

New Virtual assistant loan program is a fantastic option for of numerous experts and you may effective armed forces group who wish to buy property. It has the very best terminology offered in comparison to other sorts of mortgage loans, along with zero down payment requirement and you may reasonable-interest levels. Before you could begin seeking your perfect home, you will have to be certain that you’re pre-approved to the loan.

Taking pre-approved cannot need if you may think, but you can still find numerous tips mixed up in procedure. Regarding meeting your financial data so you’re able to submitting them having comment and you will getting an endorsement letter, there is a lot that have to be completed to score pre-approved to have an excellent Va loan.

What is actually Va Financing Pre-Acceptance?

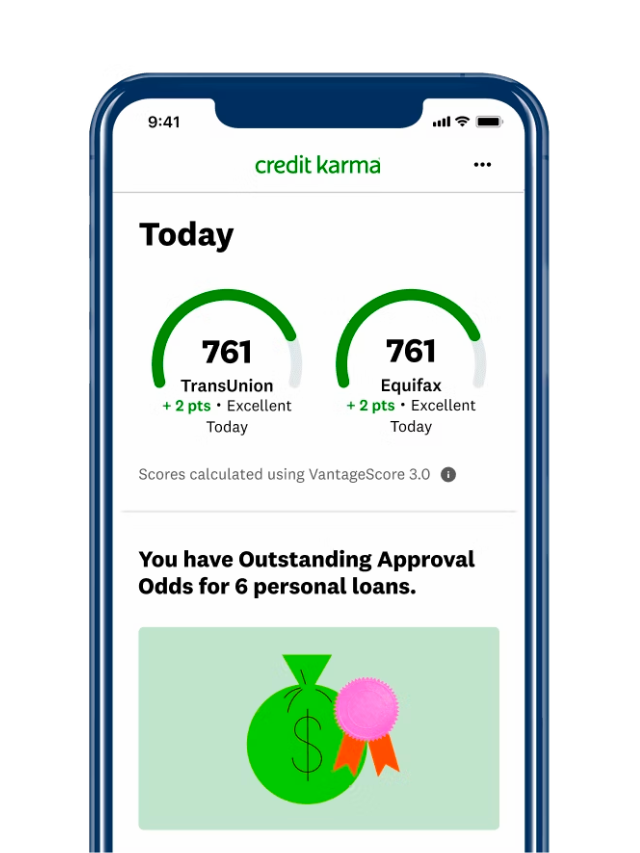

Va mortgage pre-acceptance is actually a procedure that lets pros and you can active military team so you can safer a good Virtual assistant loan for buying a house . That it loan try backed by the latest U.S. Service away from Experts Points , which makes it easier to possess experts to qualify for financial resource having way more beneficial conditions than just traditional mortgages. Brand new pre-recognition techniques comes to distribution advice just like your income and you can credit get, and also other documents, towards financial so they can feedback your own qualifications with the loan.

This new pre-recognition techniques takes from around a few days to numerous months according to the lender’s standards and your variety of finances. Like, when you yourself have a lesser credit rating or maybe more financial obligation-to-earnings proportion, it might take offered to obtain approval than simply for those who have advanced level credit and you may a low debt-to-income proportion. As well, certain loan providers may require most papers or confirmation of one’s pointers ahead of it approve the loan. Bringing time ahead of time to prepare all paperwork might help automate this process and also have you closer to running your ideal household shorter.

Why is Va Loan Pre-Approval Very important?

Va mortgage pre-acceptance is a vital action for pros and you can active army team looking to buy a house. They besides helps them know if they be eligible for an excellent Virtual assistant loan in addition to provides them with the chance to safer investment with an increase of positive words than old-fashioned mortgage loans. Pre-recognition in addition to lets customers making an aggressive promote on the picked house, since the vendors understand consumer has already been recognized to the loan.

- will bring clearness about your financial situation before purchasing a property.

- tells you how much you really can afford and which off home loan repayments we offer.

- makes it much simpler examine some other lenders and acquire an educated mortgage speed.

- can help boost your bring when designing a deal on the wanted property

- offers much more positive words than simply traditional mortgage loans, such as for instance zero down-payment specifications and lower closing costs.

Pre-acceptance is an essential 1st step undergoing to shop for a home having a great Va loan, and you will probably saving thousands of dollars eventually. Getting big date in advance to gather every needed data files and you will guidance will help automate this action being start seeking your perfect family ultimately.

How much time Can it Sample Score Va Loan Pre-Approval?

Just after all the expected records and suggestions was gained, it is time to start brand new Va financing pre-acceptance processes. This course of cash loans Wiggins CO action needs anywhere between a couple of and a month , according to lender . During this time, the financial institution often opinion your debts and you may credit score so you can know if you are qualified to receive a Virtual assistant loan. They may likewise require most documents or confirmation of a few of all the info provided.