USDA lenders within the Oregon promote a path so you’re able to homeownership having people within the qualified outlying and you may residential district regions of the state. Given of the All of us Company away from Farming (USDA), this type of money render beneficial terms and conditions, including lower or no downpayment selection and you may competitive rates.

Customized to promote homeownership and you can neighborhood development, USDA finance when you look at the Oregon act as an accessible financial support provider, eg beneficial in the event you will get deal with demands qualifying for old-fashioned mortgage loans. Let us talk about brand new unique keeps and you can great things about USDA money during the Oregon, empowering residents to show the homeownership goals on fact in the Pacific Northwest.

What’s a great USDA Mortgage?

An excellent USDA financing are a federal government-recognized home loan system designed to offer homeownership inside outlying and you can suburban parts across the You. The primary intent behind USDA funds is to try to offer reasonable capital alternatives for people and you will group who may not qualify for old-fashioned mortgages. Borrowers may use an enthusiastic Oregon USDA financial to get a keen current family and take out an excellent USDA structure loan from inside the Oregon to build a property in the ground up.

Qualifications for USDA mortgage brokers in the Oregon is determined based on situations for example income, possessions location, and you may family size. These types of finance seek to help lower- to moderate-money consumers through providing favorable terminology, together with reduced or no down payment criteria and competitive rates. Because of the assisting accessibility sensible property when you look at the outlying and suburban teams, USDA loans donate to community creativity and you may monetary stability in these areas.

USDA Mortgage Criteria from inside the Oregon

USDA financial criteria in the Oregon cover requirements you to consumers have to fulfill so you can qualify for it resource solution. Key elements are:

- Income Qualification: So you can be eligible for an effective USDA loan within the Oregon, individuals must make sure its domestic earnings falls in this certain limits determined by the area’s average earnings.

- Possessions Place: Attributes eligible for USDA finance need to be situated in designated outlying or residential district regions of Oregon. Borrowers is also make certain a beneficial property’s qualifications using the USDA’s online eligibility chart unit .

- You.S. Citizenship otherwise Long lasting House: Individuals need to be U.S. people, non-citizen nationals, otherwise qualified aliens having court home status in the us in order to be eligible for a great USDA mortgage in the Oregon.

- Economic Stability: Lenders measure the borrower’s monetary stability, and additionally things including a position background therefore the capability to pay for mortgage repayments and you will associated expenses.

- Documentation: People should provide paperwork verifying money, assets, or any other monetary recommendations within the USDA loan application procedure inside Oregon.

In advance of studying a lot more about particular lender recommendations, you will need to concur that you are able to fulfill these standard USDA financing conditions first.

Benefits and drawbacks away from USDA Financing

When weigh the advantages and you may cons regarding USDA money having homeownership when you look at the Oregon, it’s necessary to check out the individuals activities that effect borrowers’ choices.

USDA rural advancement loans in the Oregon bring several advantages to possess household people throughout the county, leading them to common for these thinking of buying property for the outlying or suburban section. You to significant advantage is the selection for reduced if any down percentage , which could make homeownership a great deal more obtainable, especially for those with minimal discounts.

As well, USDA head money for the Oregon will include aggressive rates versus conventional mortgage loans, providing consumers spend less across the life of the borrowed funds. Furthermore, this type of fund ability flexible borrowing criteria, and an improve refinance help system, leading them to offered to people who have reduced-than-primary borrowing histories. A different benefit ‘s the feature to own providers so you can contribute towards the consumer’s closing costs, reducing the upfront bucks necessary within closure.

However, USDA rural fund also have specific downsides to adopt. That restrict is the significance of services to-be based in designated rural or suburban components, that could maximum choices for home buyers exactly who like urban areas. While doing so, USDA financing has earnings restrictions based on the area’s average income, probably excluding highest-income households of qualifying.

Borrowers should also be aware of the newest be certain that payment from the USDA money when you look at the Oregon, and that enhances the overall cost americash loans Bristol away from credit. Knowledge such positives and negatives can help people build advised behavior when considering whether an effective USDA home loan in Oregon is great in their mind. The latest Oregon make sure percentage was step 1% of your own amount borrowed initial, in fact it is funded, and you can .35% a-year.

Being qualified for a USDA loan within the Oregon also provides a special options purchasing a house which have low income . However, it is important to remember that if you find yourself USDA financing have more everyday credit conditions compared to old-fashioned fund, lenders still determine various financial situations outside of the general eligibility conditions. These include the fresh borrower’s credit history, debt-to-earnings (DTI) ratio, and the go out elapsed just like the one early in the day case of bankruptcy or property foreclosure.

Griffin Financing also have USDA fund to consumers having a cards get only 600. While this requirement is lower than what traditional fund could possibly get consult, that have a top credit rating can invariably improve borrower’s potential of securing favorable loan terms and conditions. At exactly the same time, lenders measure the borrower’s DTI proportion, and therefore compares their monthly debt money to their terrible month-to-month money. A lowered DTI ratio indicates an even more manageable personal debt load and you will raises the borrower’s power to manage home loan repayments.

Away from personal bankruptcy or property foreclosure background, lenders typically require a standing several months immediately following like occurrences in advance of granting a great USDA application for the loan. The waiting months may vary with regards to the activities and the new lender’s regulations however, generally range off three in order to 7 age. To carry out a great USDA financing which have Griffin Funding, no less than 36 months have to have passed because your past bankruptcy proceeding or property foreclosure.

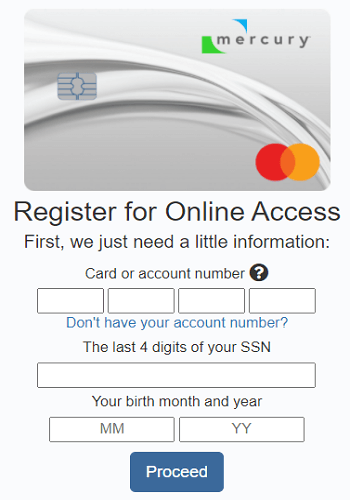

Concurrently, borrowers ought to provide documentation to verify earnings, assets, and other economic information within the loan application process. By fulfilling these lender criteria in addition to the USDA’s general qualifications conditions, possible home buyers inside Oregon can condition by themselves to help you be eligible for good USDA loan and you can achieve the homeownership requires.

Get a good USDA Mortgage when you look at the Oregon

Making an application for a good USDA home loan in the Oregon reveals doors to homeownership, especially for individuals with straight down earnings. Understanding the specific financial criteria, along with credit rating, debt-to-earnings proportion, and you may financial history, is vital to possess a successful software techniques.

Griffin Financial support really stands happy to assist possible people during this excursion, offering tailored alternatives and you may pro suggestions. Take advantage of aggressive pricing, personalized recommendations, and you can valuable information like the Griffin Gold application . With Griffin Capital as your spouse, navigating the complexities out-of protecting a good USDA mortgage for the Oregon becomes more down, even after low income. Submit an application today to get yourself started your home to purchase trip.